SAM Housing Plan Course | LWVT REVIEW | 5/31/22

1

HOUSING PLAN COURSE: TABLE OF CONTENTS

INTRODUCTION

• Housing: A Big Expense and a Potential Setback

SIZE UP YOUR HOUSING SITUATION

• Calculate Your Housing Costs

• Rent and Mortgage Guidelines

• Know Your Debt-to-Income Ratio

ANALYZE YOUR CIRCUMSTANCES

• How Much House Do You Need?

• Why Rent?

• Why Own?

• Estimate Moving Costs

• Calculate Cost of Living

MAKE YOUR HOUSING PLAN — I WANT TO RENT

• Get Ready to Rent: Upfront and Recurring Costs

• Renter Rights and Responsibilities

• Landlord Rights and Responsibilities

• Types of Lease Agreements

• Renters Insurance

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

2

MAKE YOUR HOUSING PLAN — I WANT TO OWN

• Why Buy?

• How Mortgages Work

• What To Look For in a Lender

• Homeowners Insurance

• Managing Your Mortgage

HOUSING RESOURCES

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

3

Why Take This Course?

Do you ever wish you knew more about personal finance? No

matter where you are in your financial journey, there always

is more to learn. SAM’s free online courses are not intended

as financial advice, but as a starting point to raise awareness,

to increase skills and knowledge related to personal finance,

and to guide you to helpful resources.

Research shows that financial education is most effective

when it is relevant to a decision you are faced with right now.

This course covers:

• Analyzing current housing expenses and opportunity costs.

• Tips for how to decide whether to rent or own.

• Preparing your finances to rent or buy a home.

Disclaimers

Throughout this course, any reference to a specific company, commercial product, process or

service does not constitute or imply an endorsement or recommendation by State of Vermont

LiveWell Vermont Wellness Program, Smart About Money (SAM) or the National Endowment for

Financial Education.

These courses and related resources may be used only for nonprofit, noncommercial educational

purposes. LiveWell Vermont and SAM make every effort to ensure the information in these

courses is current, but, over time, new developments as well as legislative and regulatory

changes may date this material. If you discover inaccurate information, please email

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

4

INTRODUCTION

On the Move

Change is inevitable. As you age, your housing preferences will change too. While United States Census

data show that most Americans move only a couple times after age 45, those later-in-life housing

decisions can be some of the most financially challenging if you’re unprepared.

Whether you are just starting out on your housing journey or you are looking to downsize for

retirement, there are some basic questions to consider. This course will help you assess your housing

needs and consider what it would take financially to upgrade to the home of your dreams.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

5

Housing: A Big Expense and a Potential Setback

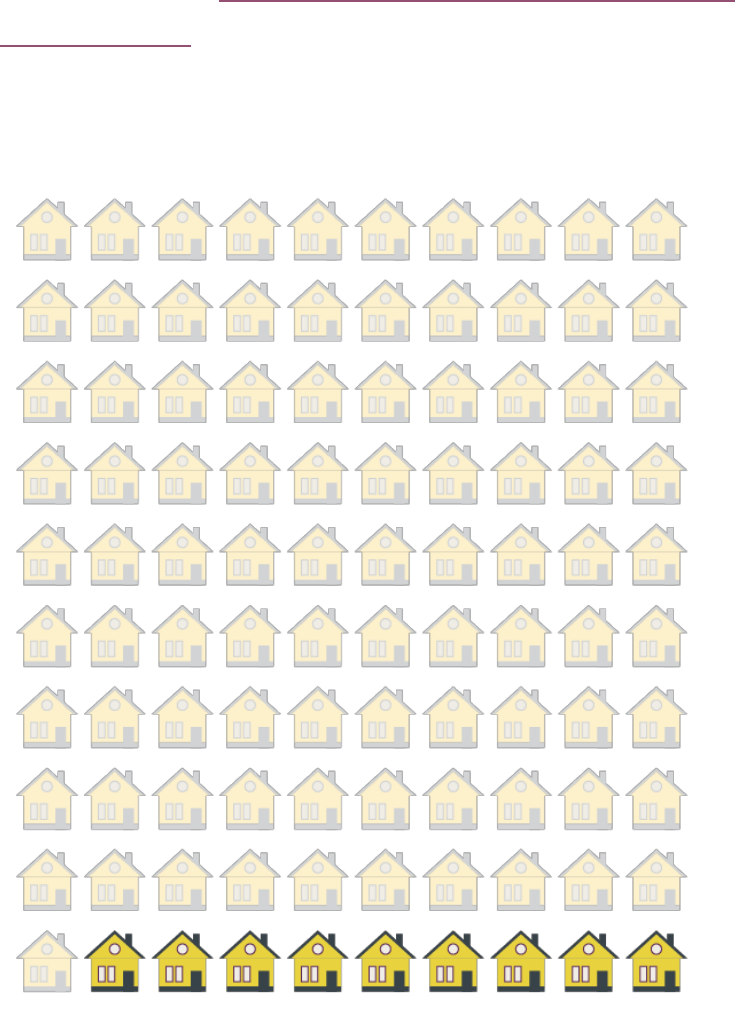

Owning a home still is the cornerstone of the American Dream, but the U.S. rental market has boomed

in recent years. More renters means more competition for fewer units and higher rents overall.

In 2014, the national vacancy rate was just 7.6 percent (down from an average 9 to 10 percent in the

previous decade) and rents rose 3.2 percent — twice the rate of inflation. In the cities hit hardest by

rising living costs, rents spiked 10 percent. This has increased the share of households that are defined

as “cost-burdened,” which means that they are spending 30 to 50 percent of their gross income on

housing.

A 7.6 percent vacancy rate means that out of 100 percent of the rental properties in the United States,

92.4 percent are currently occupied. Put another way, if 100 renters went looking for an apartment in a

city with an 8 percent vacancy rate, only 8 out of 100 would be able to find an available apartment.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

6

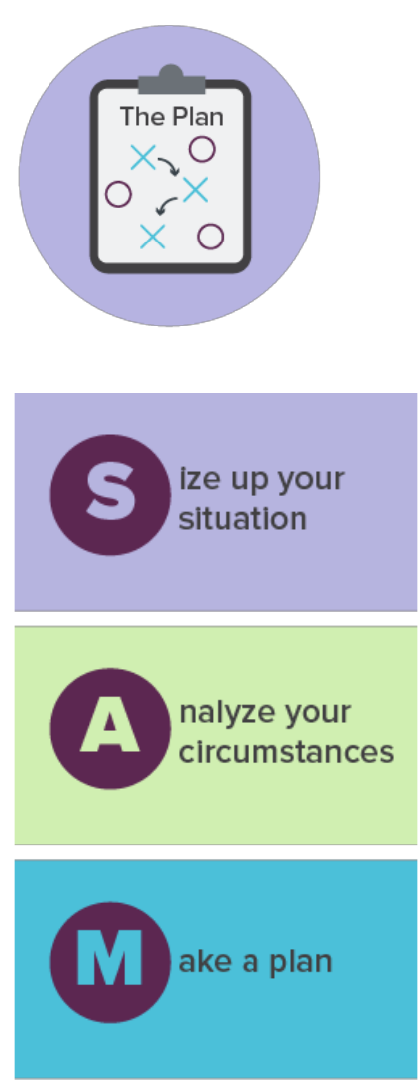

Make a “SAM” Plan

You make decisions every day – some are easy but others require

complex thought and planning. When you decide to make a

change in your housing or if life circumstances prompt you into

making that change, you want to take a methodical approach

using the SAM action steps.

Are you satisfied with your current living arrangement?

Think about where you want to live next. What would

you hang on to or change? What are you current

housing costs?

Does your current housing situation align with your

preferences? Can you afford your current living

expenses? Are you financially ready to change your

housing situation?

If you want to change your housing situation, what

adjustments need to be made? What is your long-range

game plan to adjust your housing needs as your life

circumstances change?

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

7

SIZE UP YOUR HOUSING SITUATION

Lenders and landlords will use different guidelines, but they

all will want to know the same thing: Can you afford the

payment and will you make it on time? They will look at the

following to determine your creditworthiness:

✓ Income from all sources

✓ Financial obligations – including other loans, credit

cards, leases, etc.

✓ Credit history

✓ Checking and savings account balances

✓ Debt-to-income ratio (the percentage of your gross

income taken up by recurring financial obligations such as

loans, leases, revolving credit, child support, etc.)

What Makes a Good Borrower?

Lenders are looking for the same qualities that you look for when you lend someone something. If a

friend borrows a book, you hope they return it in good condition. If you lend a family member money,

you hope that he or she will pay you back on time, according to terms that you both agree on.

Dig deeper with SAM’s Credit and Debt Basics Course.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

8

Calculate Your Housing Costs

There are varying guidelines for how much to spend on

housing, but it all begins with your income. How much you

make will determine what you can afford.

To calculate your housing costs:

• Total all of your monthly housing expenses

o If you are renting, include your rent, utilities and renters insurance.

o If you own, include your mortgage, property taxes, homeowners’ insurance and

homeowners’ association (HOA) fees.

• Divide this figure by your gross monthly income (before taxes and any other adjustments).

• The amount, expressed as a percentage, shows how much of your earnings are used to pay for

housing.

For example:

Monthly housing expenses = $1,300

Monthly gross income = $4,000

1,300 / 4,000 = 0.325

(move the decimal two places to the right)

= 32.5 percent

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

9

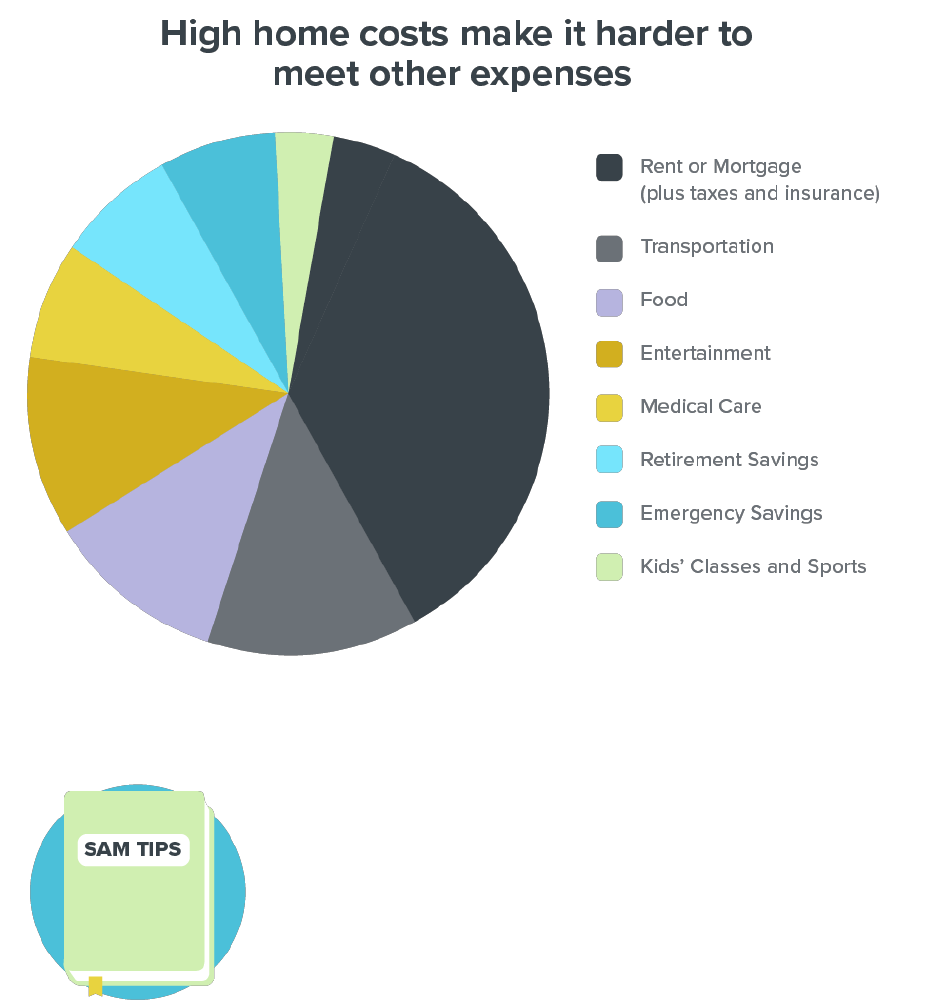

Are You Cost-Burdened?

If you spend 30 percent or more on housing costs, you are considered cost-burdened, meaning that you

could have problems paying other bills due to high housing expenses.

Think of it this way: If 30 to 50 percent of your gross paycheck (income before taxes) is taken up by rent

and mortgage costs, that leaves only two-thirds to half of your income left to cover other things.

To figure out what 30 percent of your monthly income is, multiply your

gross income by 0.30.

$4,000 (monthly gross income) x 0.30 (30 percent with the decimal

moved two places to the left) = $1,200.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

10

Know Your Debt-to-Income Ratio

In addition to your income, mortgage lenders calculate your debt-to-

income ratio (DTI) to estimate the likelihood that you will be able to

repay your mortgage loan. Your DTI shows how much you owe (your

debts) compared to how much you make (your income).

Even if you have no plans to buy a home, it still can be helpful to

calculate your debt-to-income ratio for a better understanding of

how your debt impacts your ability to meet other obligations.

To calculate your DTI:

• Total all of your monthly debt – include your mortgage, all loans (home equity, car, student,

etc.), the minimum monthly payments on all credit cards, and any other recurring debts for child

support, alimony, personal loans, etc.

• Divide this figure by your gross monthly income (before taxes and any other adjustments).

• The amount, expressed as a percentage, is your debt-to-income ratio. It shows the percentage

of your earnings that are used to pay your debts.

For example:

Monthly debt obligations = $800

Monthly gross income = $4,000

800 / 4,000 = 0.20

(move the decimal two places to the right)

= 20 percent

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

11

Rent and Mortgage Guidelines

As a general guideline, it is recommended that you keep your

rent (rent burden) or mortgage payment below 40 percent of

your gross (pretax) annual income.

This is just a guideline, and your situation is unique. Even if

you currently spend more than 40 percent of your income on

housing and have no difficulty paying off debts or meeting

other obligations, you still might explore lowering your

housing costs for other reasons — such as paying off your

debts faster or saving more money for emergencies,

retirement and investments. Once your current needs are

met, it’s time to think about the needs of the “future you.”

Mortgage Lender Guidelines

When you apply for a home loan, lenders look for your housing costs (principal, interest, property taxes,

and homeowners’ insurance — or PITI) to be around 28 percent of your gross income, lower than the 40

percent guideline. The other common industry standard is for your debt-to-income ratio (i.e., PITI plus

consumer debts) to be no more than 36 percent.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

12

Check Your Credit

Mortgage lenders and landlords want to make sure you

will be able to pay your housing obligations. To make this

determination, they will look at your credit report and

credit score. Each year, you are entitled to one free copy

of your credit report from each of the three credit

reporting agencies: Experian, Equifax and TransUnion.

You can request your credit reports at

AnnualCreditReport.com.

What’s in a Credit Report?

A credit report serves as your credit reference. Credit

reporting companies provide information about your

credit history so that other potential lenders can decide to lend to you or not. Your credit report

includes information about:

• Where you live and work

• Amounts, credit limits and balances of past and current credit accounts

• Your payment history, including late payments to other creditors

• Any unpaid debts, including those that have gone to collections

• Bankruptcies

Correct Errors on Your Credit Report

Part of the process of maintaining good credit is watching for errors on your

credit report that are not your fault. Some errors are honest mistakes, while

others can be the result of a thief stealing your identity. Learn about

correcting credit report errors in SAM’s Credit and Debt Basics Course.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

13

Know Your Credit Score

Lenders and landlords use your credit score to estimate

how risky it would be to lend you money. Your credit score

is a simple way of representing your creditworthiness

based on your past and present actions.

Different lenders use different scoring methods, and your

score can change over time. Your credit score will reflect:

• How much credit you have used compared to what is

available for you to use

• How often you apply for new credit

• How long you have used credit

• The types of accounts you have and the number of accounts you have

• How you have used credit in the past

• Any legal proceedings against your credit

A good score depends on the scoring model that is used, but a majority of lenders will look at your FICO

score.

Improve Your Credit

To keep a good credit rating or to improve your credit:

✓ Pay your bills on time, all the time – even if it’s just paying the minimum due.

✓ Use existing credit wisely to establish a good payment history.

✓ Don’t hit the credit limit — pay down any high debt.

✓ Avoid taking out new credit when you don’t need it.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

14

ANALYZE YOUR CIRCUMSTANCES

Can You (And Should You) Afford It?

Just because you can do something doesn’t mean you should do it. Your parents might consider buying a

home a no-brainer. Your friends might want to live in a trendy neighborhood. But these are big

decisions. It is important to make sure that you are coming to sound conclusions on your own. Ideally,

your living situation should bring you joy, security and comfort — not stress and worry about paying

your bills.

Gut-Check Time

The Financial Planning Association (FPA) recommends asking yourself the following four questions

before you decide to buy a home. These also can apply to renting your next home.

Question

Yes

No

Is your credit in good shape? Lenders and landlords will want to analyze your

ability to pay your mortgage or lease.

Do you have a steady job history? Most lenders and landlords will want to see

evidence of steady employment for two years. You will be asked to explain

gaps in your employment history.

Can you really afford to make the monthly payments? Take into account all

your monthly debts and the recommended guidelines for mortgages and rent

payments.

Have you saved for a down payment, closing costs, move-in costs or other

fees?

If you answered “no” to any of the above questions, the FPA suggests you

wait and give yourself more time to get financially ready to buy or rent

your home.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

15

How Much House Do You Need?

Not everyone would choose to live in a mansion, even if they had the

money. Some people prefer cozier spaces and find big houses

overwhelming.

Some people love having lots of room inside, and don’t mind just a small

patch of yard, while others would give up square footage inside for a big

plot of land.

Think about all the members of your household — will your kids need separate rooms soon? Are you

tired of making your in-laws sleep on the sofa when they visit? Have you always wanted a separate

dining room or detached garage?

Activity

Make a list of the types of space, rooms, storage and outdoor areas that you prefer. Don’t hold back at

this point — this is just to get a clear sense of your ideal situation. But be somewhat realistic as well. It’s

fun to fantasize about your dream house, but it’s more useful to brainstorm what type of home would

make you feel secure and comfortable, allowing you and your family to thrive.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

16

What’s In a Neighborhood?

Whether buying or renting, when you move to a new area, you are

becoming part of a larger neighborhood community where you will

want to feel at home.

What makes a good neighborhood? Here are a few things to

consider:

• Crime rate – Check out whether crime rates are increasing or

decreasing in your proposed neighborhood. RAIDS Online offers a

quick crime mapping tool, but the most reliable source will be the

local police department.

• Schools – Families with children will want a good school and school district. Check out

GreatSchools.org for more information about the district and particular school your child might

attend.

• Transportation – Is there nearby access to public transportation? Even those living in suburban

areas may need public transportation if the car breaks down.

• Commute time – As of 2013, the U.S. Census reported that 86 percent of U.S. workers

commuted to work by car, and 3 out of 4 drove alone. Long commute times can impact your

pocket book (gas), your health (cardiovascular and metabolic health), and your general level of

satisfaction.

• Shopping, restaurants and entertainment – Unless you live in a rural location, nearby amenities

for grabbing a bite or seeing a show can be an important consideration.

• Lifestyle match – Consider your life stage. Single professional? Perhaps a downtown condo with

access to bars and restaurants. Retiring? Maybe you want a patio home where someone else

handles yard maintenance. Married with children? You might want a suburban neighborhood

with other families.

• Weather and climate – If you’re a fan of the outdoors, you’ll want a climate suitable to your

adventures. Use the Weather Channel to check out regional forecasts for your potential new

locations.

• Health care – Check out access to health facilities (hospitals, urgent care, doctors) as well as

recreational facilities.

Activity

Identify a neighborhood where you think you would like to live. If possible, visit that neighborhood and

envision what your life might be like if you lived there. Which grocery store would you go to? How hard

would it be for you or your guests to find street parking? Are there parks or trails nearby where you

would walk your dog? Is the neighborhood bike-friendly? Make a list of your “must-haves” and “nice-to-

haves” in your next home’s location.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

17

Prepare for Expected (and Unexpected) Life

Changes

Whether you are a homeowner or a renter, unexpected events will

test even the best-laid spending plans. In addition to life’s surprises,

your housing needs might change in more predictable ways, for

example, as children are born and move out, as parents age and as

you prepare for your own retirement.

Build Up Your Emergency Fund

Having a monthly budget for your new place is one thing, but what happens when you suddenly need a

new furnace or your car breaks down the week after you move?

Illness and employment can be equally unpredictable. If you were laid off or temporarily disabled, how

long could you pay your bills without borrowing or relying on credit cards? Research shows that many

Americans could not cover a $400 expense out of pocket.

Jeronna’s Story

Jeronna Bolden thought she had done everything right, until the job she

had been promised fell through and she found herself homeless with her

6-year-old son.

Dig deeper with SAM’s Emergency Fund Plan Course.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

18

Housing Needs in Retirement

As the Baby Boomer generation ages, the average age of Americans

is rising as well, and that means more people transitioning out of

their family homes and into more manageable living situations for

their later years.

Be realistic and get a clear picture of your finances before rushing to

move. You might consider:

Downsizing

If you no longer need a large home, you could downsize your accommodations. That may mean moving

to a smaller traditional home or renting, which could mean less overall maintenance and cost.

Retirement Community

If you want little or no maintenance responsibilities, you could move to a retirement community or a

condominium. The downsides to shared-living arrangements such as these are homeowners’ association

fees, which typically increase over time to keep pace with inflation and generally are not tax-deductible.

Housing is just one aspect of your retirement

plan. Visit MyRetirementPaycheck.org for more

on how to pay yourself in retirement.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

19

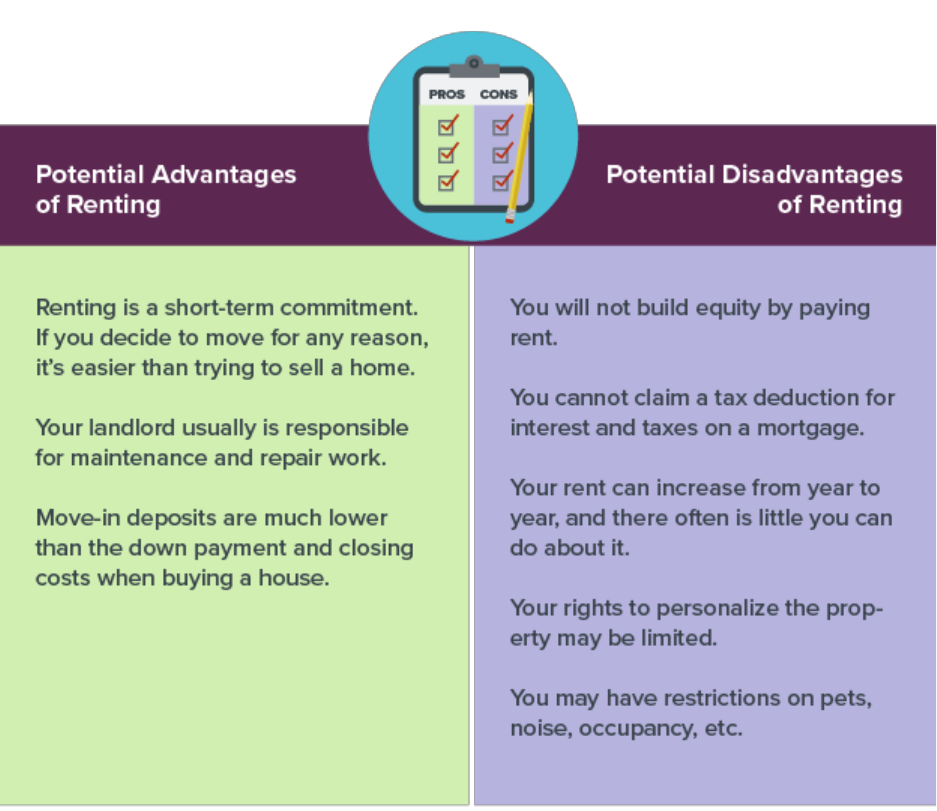

Why Rent?

Homeownership is not for everybody. If your job isn’t stable or if you travel often, purchasing a home

may not be worth the expense. And, if you have credit problems, you are living paycheck to paycheck or

if you find it difficult to prove your income, it may be tough to qualify for a mortgage. If you don’t want

the responsibility of home maintenance and you’re not sure of your future plans, renting may be an

excellent choice.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

20

Renters: Beware of Missed Opportunity

Costs

Before you sign your next lease, consider some of the potential

opportunity costs of renting rather than owning:

• By renting, you miss the opportunity to build equity in a home. When you buy a home, every

mortgage payment goes toward paying off some of the money that was borrowed

(principal). Home equity is the difference between the market value of a home and its

outstanding debt balance. It also is considered one of the most effective ways to build up

savings.

• When you rent, your payments go to helping the landlord pay his or her mortgage, not to

building your equity.

• Renters miss out on income tax write-offs. Homeowners can deduct mortgage interest and

property taxes on their annual tax returns.

As rents increase, you might find that monthly mortgage payments are less than monthly rent,

depending on your circumstances. Homeowner tax advantages might even make it possible for you to

buy more home than you rent for the same monthly payment. However, keep in mind that buying a

home typically requires a large down payment and good credit history.

Help for Homeowners

There are programs available to help potential homeowners. Check out the Resources section of this

course for some places to start.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

21

Why Own?

Owning a home gives you several important financial benefits, including equity, tax write-offs and the

opportunity to leverage a small amount of your own money to make an investment of much larger

value.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

22

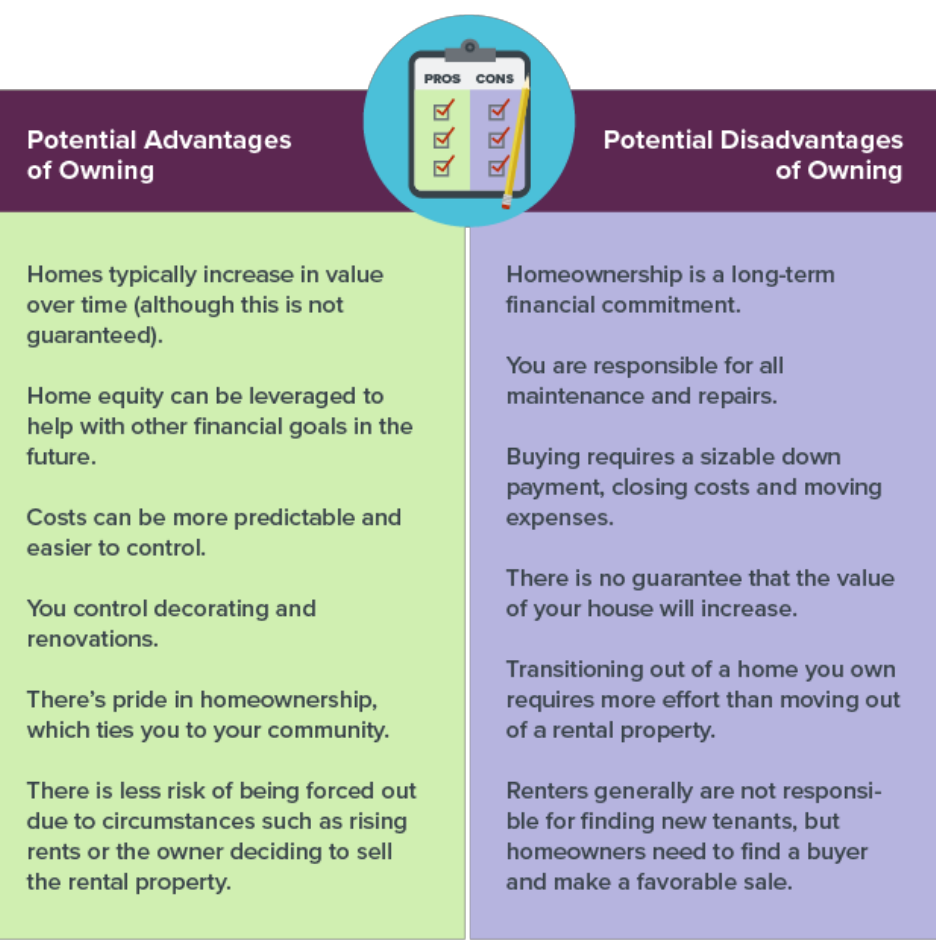

Estimate Moving Costs

Moving to a new place or new city can open up new opportunities,

but keep in mind that moving is, in itself, expensive and often

stressful.

The True Cost of Your Move

Whether you plan to rent or buy your next home, plan ahead to cover

moving costs. Every situation is different, so not all of these will apply.

Some costs apply to both renters and buyers.

Don’t Count On That Security Deposit

If you are hoping to apply the security deposit from your current place to the deposit on your next

apartment, don’t count on it. Check your lease, but most landlords have a grace period of at least 30

days to return your deposit to you. And even then, you are not guaranteed to get the total amount back.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

23

Calculate Cost of Living

Moving to a new city can be exciting and invigorating, but a

change of scenery also can come with an increase in cost of

living.

Before committing to relocate — even if you have a job

offer that pays more — consider the cost of living in the

new location. Daily expenses such as food, parking and

public transit can vary dramatically depending on where

you live.

Cost-of-Living Calculators

• The CNN Cost-of-Living calculator compares how far your salary will go in U.S. cities.

• The Living Wage Calculator estimates the cost of living, including some common expenses in

a particular community.

• Sperling’s Best Places Cost of Living Comparison lets you compare the cost of living from one

city to another using your current income.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

24

MAKE YOUR HOUSING PLAN: I WANT TO RENT

Get Ready to Rent: Know What You’re On the

Hook For

Before you sign a lease, make sure you and your budget can

support additional expenses beyond rent.

Check with your potential landlord to be sure what is covered in

the rent and what is extra, such as:

• Parking

• Utility fees (electricity, gas, water)

• Phone service

• TV service

• Internet service

• Trash pickup

• Common area use fees

• Renters insurance to protect the personal items in your rental unit from theft, fire, storms and

other damage

Don’t be afraid to ask what average amounts were paid by the

previous tenant for utilities such as gas, water and electricity. You

can control how high you turn up the A/C, but you can’t control high

energy costs due to poor insulation and drafty windows.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

25

Ali’s Story

“I’ve always dreamt of living in my first apartment, all decorated

cute, and something that when someone came to visit, I could

be proud of,” says Ali Kvidt, a freelance photographer and nanny

who lives in Minneapolis.

But for Ali, the reality of planning, preparing and paying for the

move to her first place was more complicated than she

expected.

One of the biggest things that took her by surprise was the extra

cost she hadn’t anticipated.

“Of course, I always knew that the deposit, application fee and electricity would need to be

paid,” she says. “But I guess I never took into account that my Internet, cable, water, heat and

trash, especially, would need to be paid. I guess I always figured that came with the rent.”

Ali could’ve let herself get tripped up by the extra expenses or ignore them completely — throwing

them on a credit card like they were no big deal. Instead, she planned ahead, saved up, and successfully

made the big move.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

26

Research Rental Rates

Rental rates are soaring because of increased demand.

When the housing market dipped in 2008, many

homeowners were displaced. Plus, saving money for a

down payment on a home has gotten harder with

more people struggling to pay down student loan debt

and save for retirement.

What is the average cost for a rental in your state?

Let’s find out:

• Think about the state in which you live and mentally calculate what you think the average price

is for a rental unit in your state.

• Now use this interactive map from MyApartmentMap.com to see what the actual average is for

the state in which you live.

Were you near the actual amount? Are you surprised? Before you shop for a rental home in your

specific area, having information on average rental prices, especially depending on the size and number

of bedrooms, can be helpful.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

27

Renter Rights and Responsibilities

You have certain rights and responsibilities as a renter. Likewise, your landlord has her own rights and

responsibilities. These can vary by state and situation, so it’s important to know what applies in your

case.

Your Rights

Generally speaking, you have a right to a habitable environment:

• Heating and air conditioning must work.

• Toilets and hot water heater must work.

• Door locks must work.

• The roof must be in a good condition (e.g., it should not leak).

• Windows must be in working order and not sealed.

• Appliances that are supplied (like the refrigerator, stove and garbage disposal) must be in

working condition.

Most of these rights fall under the “implied warranty of habitability” which is a warranty (implied by law

simply by leasing the property) that the landlord promises that the property being leased is safe and

suitable to be lived in. Breaking this implied warranty can be grounds for the renter to break the lease,

and in some instances, to sue the landlord.

Learn More About Renters Rights

The U.S. Department of Housing and Urban Development (HUD) offers

state-by-state assistance for renters to learn more.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

28

Renter Responsibilities

Your responsibilities as a renter will vary too. It is important to

understand your rental agreement so that you know exactly what your

responsibilities are, especially concerning maintenance and repairs. For

most renters, these responsibilities will be addressed in the lease

agreement:

• You will maintain the property in a clean and habitable condition.

• You will inform the landlord when issues arise that could harm the value of the property.

• You will pay for any repairs due to your negligence or misuse of the property.

When You Can’t Pay Rent

Most landlords will not evict you if you are a bit late paying your rent, although you may be charged a

late fee. But if you find that you cannot pay your rent or your income is drastically reduced, you need to

be proactive about contacting your landlord. The important thing is to communicate.

• Ask to negotiate a late payment in advance of your payment date.

• Offer to pay some of the rent by the due date.

• Explain your circumstances and how you expect to resolve them so that your rent will be paid on

time in the future.

It pays to know the tenant rights in your state. Start with the U. S.

Department of Housing and Urban Development’s state portal.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

29

Landlord Rights and Responsibilities

Just as your rights as a tenant vary by state, so do the rights and

responsibilities of your landlord. Your lease should define exact rights of

the landlord, which is why it’s important to understand the lease before

you sign.

Landlord Rights

• The right to collect rent. Simply by the fact that you are renting, your landlord has the right to

collect rent and any prearranged late fees for overdue rent payments.

• The right to raise your rent according to your lease agreement.

• The right to evict. Your landlord has the right to evict you, especially if you do not pay your rent.

State laws vary regarding eviction proceedings, but most will allow the landlord to collect back

rent and any legal costs associated with an eviction.

Landlord Responsibilities

• The responsibility to keep the property safe. This covers basic safety like proper wiring to

prevent electrical issues, flooring that does not cause one to trip, etc.

• The responsibility to not discriminate. This is covered by the Fair Housing Act.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

30

Handling a Landlord Dispute

Unfortunately, disputes can arise between a landlord and tenant

over the rights and responsibilities of each party. Here are a few

guidelines to help:

1. Avoid disputes. Refer to your lease agreement to see what has

been agreed to in the first place. Also get to know your legal rights

at the federal, state and local levels. HUD offers state-by-state

assistance for renters.

2. Notify your landlord immediately if there is a problem. Don’t let

it fester.

3. Keep copies of all correspondence with your landlord regarding any issues that arise.

4. Mediate the problem. Mediation is a voluntary meeting between two parties with an impartial

third party who can find areas of agreement and help resolve differences. Often inexpensive

(compared to lawyers), the mediation agreements can sometimes help resolve issues without

courts and lawyers.

If the differences still cannot be resolved, you may need to pursue legal action in small claims court.

Violations of the Fair Housing Act can be filed online.

Fair Housing Act

The Fair Housing Act is a federal act that protects buyers and renters from discrimination. Under the Fair

Housing Act, a landlord or seller cannot discriminate against a renter or buyer based upon race, color,

nationality, religion, sex, disability or familial status (the number of children you have). Despite

continuing efforts to strengthen the act, there are continuing reports of discrimination.

If you feel you are discriminated against, you can file a complaint with the Office of Fair Housing and

Equal Opportunity (FHEO). Learn more at HUD about the basics and what to do if you think your rights

have been violated.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

31

Types of Lease Agreements

A lease is a legal agreement between you and a landlord. Leases

obligate you and your landlord to specific commitments. Some

landlords may require a co-signer to the lease if you are under a

certain age or do not have much credit history.

The most important obligation of your lease is the length of time

it is in effect. When you sign a lease, you agree to rent the

apartment for a specified period of time and your landlord agrees

to rent the property to you for that same amount of time.

Your lease obligation applies whether you live in the apartment

or not. If you choose to leave your rental unit before your lease is up, your landlord legally is entitled to

the rent you owe for the time remaining on your lease.

• Short-term lease: A short-term lease normally will state a fixed monthly rental rate for the entire

duration of the lease. If you know you are planning to stay in the apartment or house only for a

short time, it makes sense to get a short-term lease.

• Month-to-month lease: With a month-to-month lease, you agree to rent for a month at a time. Your

rental price is subject to change at any time (as long as your landlord provides the appropriate

notice to you as defined in your lease). If you are unsure about how long you will occupy the rental

unit, a month-to-month lease may be the best option for you.

• Subleasing: If you sublease (sometimes called sublet) an apartment or house, you are renting a

property under an original lease that someone else holds. You normally work out the arrangements

with the original tenant rather than the landlord. If you are going to sublease, be sure to obtain

written consent from the landlord allowing you to live in the apartment or house for the duration of

your agreement with the original leaseholder.

No matter the type of lease, be very sure that you understand and can meet the terms of your rental

agreement. If for some reason you want to end your lease early, carefully read your rental agreement to

understand any penalties for breaking the lease. You may owe a part or all of your remaining rent for

the year, owe a hefty fee or lose your security deposit.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

32

Common Lease Terms

A lease is an agreement between you and the property owner. It is made in good faith, meaning that no

one intends on harming the other party. But the lease also is a contractual agreement. Before you jump

into any agreement, it’s important to take a close look at it and understand what you are signing.

Remember to carefully review the terms of the lease so you know what you are on the hook for

financially. You also will want to inventory the leased property before you move in by walking through

the property with the landlord to note any deficiencies prior to moving in. And, always get the

agreement or modifications to the agreement in writing.

Get to Know Lease Terms

If you are unsure of a term or clause in a lease, ask the landlord to define what it means. Don’t be afraid

to ask, and don’t let your landlord gloss over it. Don’t be embarrassed to take your time, call someone

for help or do an Internet search for words and phrases that you don’t understand. Among other items,

look for these common clauses in your lease agreement.

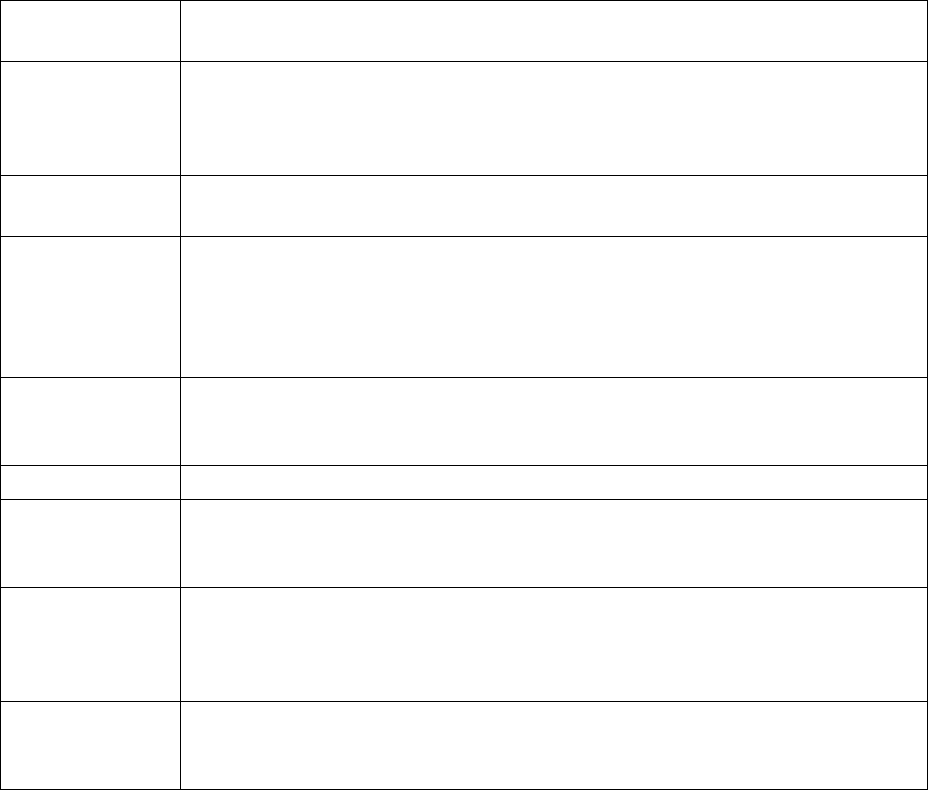

Term or Clause

Description

What’s Important

List of tenants

This is the complete list of all adults occupying the rented unit. It’s important to

the landlord, in particular, who can collect the full rent from any individual listed.

The landlord also can terminate the lease if one person listed violates a term of

the lease.

Rent due

This should be the exact amount due, when, grace periods (if any), how and

where payment should be made, and fees for late payments.

Time period

(term)

This is the number of months being rented. This should be very specific and

should outline what happens once this length of time passes. For example, does

a one-year lease become a month-to-month rental after a certain point? Does

the amount for the rental increase? The lease also should specify when the

terms can be changed.

Deposits and fees

It should be specified whether deposits are refundable or not, and under what

conditions. Your lease or rental agreement also should specify how the deposit

will be refunded and the time frame in which it will take place.

Utilities

This section should identify all utilities you will need to pay, outside of the rent.

Right to enter

the premises

This clause should specify exactly when and under what conditions the landlord

can enter the premises being rented. State laws regulate this, so get to know

what is permissible in your state.

Maintenance/

repairs

Get a detailed list of major repairs (that the landlord will be responsible to fix)

and minor repairs (that the renter will fix) and how/when to notify the landlord

that something needs maintenance or repair. Remember that each party has

certain responsibilities in this arrangement.

Occupancy rules

The lease probably will stipulate that only the adults on the agreement (and

their children) may occupy the premises. Also look for information regarding

pets, including types, numbers and additional fees for them.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

33

Some agreements will list restrictions on disruptive or illegal behavior, information on subletting, what

common areas are available for use, parking arrangements, etc. Lease and rental agreements can vary

by state, so be sure you know what is applicable to your particular case.

And, ask what the landlord’s insurance covers in terms of property damage from unexpected events

such as fire or broken pipes.

Do an Internet search for sample leases to see what a typical lease

might look like.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

34

Walk Through Before You Sign

Before you actually sign a rental agreement, perform a walk-through. If the place you are renting is

occupied, ask if you can sign the lease once the premises are vacant. You don’t want to find out that

furniture or rugs are hiding unsightly or unclean areas of the rental.

Do your walk-through with the manager first, getting sign off on any problems you find. Document

damages with time- and date-stamped pictures with a cellphone. Most reputable landlords will have a

checklist to fill out before move-in and at move-out.

Courtney’s Story

When Courtney went looking for her first apartment in her hometown of

Tucson, Ariz., one offer was too good to pass up. It was close to work and the

first month was free. She signed a one-year lease and moved in. The carpet

was a wreck — worn thin and coming up in places, but the move-in flier

promised new carpet as needed, and the property manager agreed that hers

qualified.

When Courtney asked about the carpet after moving in, she found out that

the original manager had been let go, the fliers were gone, and there was nothing in the lease about

new carpet.

Courtney soon discovered the problem was worse than she thought.

“I saw this giant roach crawl out from under the carpet where it was coming away from the walls,” she

says, “and when I lifted it up, there were dead roaches and roach skins everywhere.”

After weeks of trying to get the carpet replaced and the apartment sprayed for bugs, Courtney decided

that she had to move out. She broke her lease and found herself on the hook for almost $1,500,

including paying for that “first month free” that she was promised when she moved in.

Looking back, she says she never would have rented that apartment with the carpet as it was, but the

manager had made her a verbal promise. Not getting that part of the agreement in writing turned out to

be an expensive lesson in things to consider before signing a legal contract.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

35

Security Deposits

Your security deposit likely will be the equivalent of one or two

month’s rent, paid up front. But getting that money back can be

troublesome. Here are some ways to make sure you get your deposit

back when you decide to move:

• Unless you are renting from a private owner, make your check out to a company rather than an

individual.

• Do some research in your state to find out what’s refundable and the rules regarding filing dispute

claims if your landlord refuses to refund your security deposit. In some cases, the landlord may have

to go to court to keep your money.

• Know what qualifies as vacating your residence and get proof when you turn in the keys.

• Refer back to pictures that you took when you moved in to show proof of pre-existing damages.

• Take pictures of the unit as you are leaving it to substantiate your claim.

If all else fails, you can have an attorney issue a demand letter or send one yourself using any one of

several online services. Small claims court also is an inexpensive way to recoup your deposit money.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

36

Maintenance and Repairs

As you would expect, your home will require maintenance and repairs. A

great thing about renting is someone else is responsible for the upkeep

of the building and the property. But not all services in your rental unit

are free — it’s important to know just who pays, for what, and when.

• Major issues are the kind that would prevent you from living

safely in the rental unit. Most often these issues are the landlord’s responsibility. Remember, the

landlord is responsible for providing a safe and habitable place.

• Minor issues, such as a blown lightbulb or furnace filter, can be your responsibility. Defects, like

worn carpet or a stained toilet, are minor because it doesn’t make your rental uninhabitable.

• Maintenance issues, like lawn mowing, snow clearing or trash pickup, may not be free.

Before you sign a rental agreement, get in writing those expenses that are factored into the cost of your

rent and those that are extra.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

37

Renters Insurance

Renters insurance covers your personal property and protects you from liability claims. It may not be

required by your landlord, but it is an important and relatively inexpensive way to protect your

possessions, including furniture and electronics, from theft, fire, storms and other damage.

You may be able to get a basic policy for as little as $12 a month. But to make sure you have enough

protection, it is important to inventory your belongings.

Dig deeper with SAM’s Insurance Course

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

38

Check Your Knowledge

Before you sign your next rental lease, rate your readiness:

Topic

Absolutely!

Not

really

Oh, I didn’t

think about

that …

I know the required move-in costs and I’m ready for them.

I’ve studied the lease and I know what I will need to pay if I

have to get out of the lease early.

I know what my security deposit is and what I have to do to get

it back.

I have crunched the numbers and I know what I need to pay

monthly for rent, utilities and other living expenses.

I know what my lease says about having pets and roommates.

I know what fees I will be charged for maintenance items and

trash pickup.

My renters insurance is selected and it will protect my

possessions from fire, theft or other damage in the rental unit.

If you answer “not really” or “didn’t think about it” on one or more topics, you still have some

homework to do. Review the areas of this course related to those topics to ensure you have a complete

understanding before moving.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

39

Set Your Renting Guidelines

To aid with your decision making, it’s a good idea to create a checklist

when comparing your housing choices.

Before you can create your checklist, however, it helps to have some

general guidelines to use. Use these sentence starters to help you think

about things you want to maintain from your current living situation,

improve on or change:

• In my current housing situation, I like ________________, and I want my new place to have that

as well.

Example: In my current housing situation, I like that there are two bedrooms, and I want my new

place to have that as well.

Example: In my current housing situation, I like that I am downtown, and I want my new place to

have that as well.

• Something I would like to improve from my current living situation is to have

_____________________ instead of ________________________.

Example: Something I would like to improve from my current living situation is to have the ability to

take public transportation instead of needing to drive every day.

• One thing I would change from my current housing situation is

_______________________________________.

Example: One thing I would change from my current housing situation is to have a yard so I can get

a dog.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

40

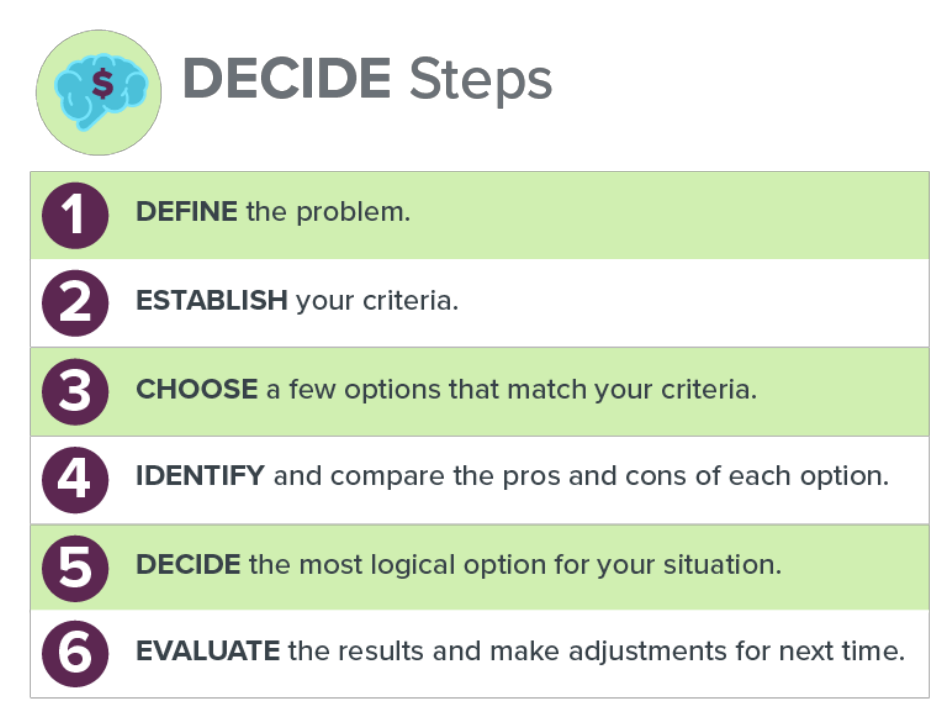

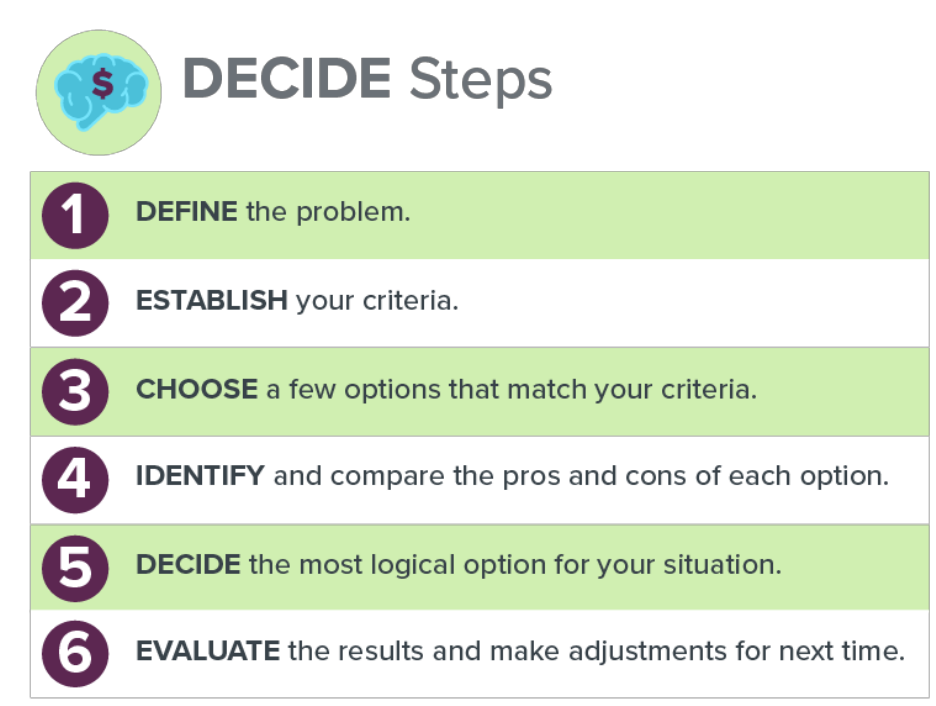

How to DECIDE

When making a decision to move, no matter if it’s for a new job, a change in marital status, retirement

or just for the sake of change, you will want to check out several options and choose the one(s) that fit

your lifestyle, values and life circumstances. But first you need to create an inventory of just what

criteria are important to you and the priority they take.

1. Define your goal. What do you want to achieve by renting your next place? Do you want to save

up to buy one day or are you looking to downsize?

2. Establish your housing criteria. Which features are wants and which are needs?

3. Choose two to three good options. It’s elimination time. Remove any options without your

must-have features to get your list down to two or three options.

4. Identify the pros and cons. Make a chart so you can quickly compare the features and prices of

each of your top two or three choices.

5. Decide what’s best. Choose the rental property that best matches your criteria.

6. Evaluate your decision. Did you stay within budget? Do you feel good about your choice? Set a

plan for how long you will live in your new place and start saving for your next move.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

41

MAKE YOUR HOUSING PLAN: I WANT TO OWN

Why Buy?

Many financial professionals consider homeownership to be the

single best avenue for building wealth. There are tax benefits as

well. Under current U.S. tax law, you can write off your mortgage

interest expense and property taxes against your income on your

primary residence if you are eligible to itemize deductions

(consult your tax advisor for details).

Owning a home can foster a sense of pride and security, knowing

that any improvements you make to the property will benefit you

rather than your landlord. Homeowners tend to have more

freedoms in a property that isn’t controlled by the rules of

others, and many people want to know that they are getting more in return for their money than just a

place to lay their head at night.

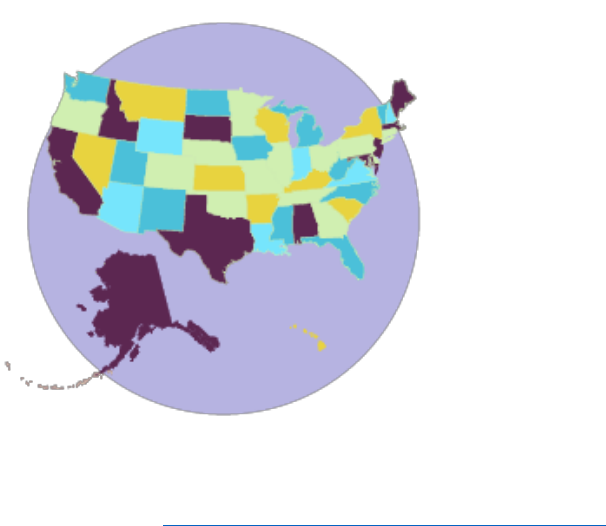

Do You Itemize?

Only 1 in 3 taxpayers itemizes deductions on their annual tax return. If

you don’t itemize deductions, you could be losing out on important

financial benefits. Check out this map to see how your county ranks

nationally in claiming tax deductions.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

42

The Costs of Getting a Mortgage

Lenders are in a business to lend you money, but they don’t do it for

free. When you decide to buy a home and get a new mortgage, you can

expect to pay fees and other costs associated with getting the loan and

closing the sale.

Typical fees and closing costs associated with mortgages include:

• Lender Fees – These are fees charged for processing the loan. There may be fees for application,

loan origination, credit reports, etc. These fees often can be negotiated, so it pays to shop

around.

• Discount Points are a type of fee that is paid at the time of the loan closing, usually 1 percent of

the loan amount. Points are charged upfront to get a lower interest rate over the life of the

loan.

• Fees Charged by Other Parties – These often include fees for searching the property’s title (to

make sure it’s clear to be sold) and appraising the property (to make sure it’s worth what you’re

paying). Others can include survey fees, attorney fees, closing fees, courier fees, home

inspection fees and title filing fees.

• Prepaid Items – These amounts typically pay your interest and taxes; these funds typically are

placed in an escrow account. Essentially, you are prepaying your interest to the lender since you

are living in the home until your first payment comes due. Likewise, you are paying property

taxes into an escrow account that will be paid to the state at the end of the year.

It’s important to review all fees before accepting the loan (and before closing).

• Never sign a document that has blanks to be filled in later.

• Don’t sign a document that has terminology you don’t understand.

• Only you can make the determination as to whether a loan is good for you.

New mortgage process regulations went into effect in October 2015. If it’s

been a while since you bought a home, see how these regulations help you

at the Consumer Financial Protection Bureau website.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

43

How Mortgages Work

When you apply for a mortgage, you quickly become immersed in a new

language. It can all sound very foreign at first, but we’ll boil down some

basics here about how mortgages work and language that is commonly

used.

First, let’s look at what you really are paying when you make a mortgage

payment. These components commonly are referred to as PITI:

• Principal – This is the amount of the monthly payment that pays off your actual loan amount.

• Interest – This is what you are paying to borrow the money for your home. It is calculated based

on the interest rate, how much principal is outstanding and the time period during which you

are paying it back. At the beginning of the loan repayment period, most of your payment

actually is going toward interest, with a small portion going against paying down the principal.

Over time this will reverse and more of your payment will go toward reducing the loan balance.

• Taxes – Most homeowners will pay their annual property taxes in periodic increments to the

lender (e.g., quarterly).

• Insurance – Lenders will require homeowners insurance, so some of your monthly payment will

be allocated to your insurance. You sometimes will also have to pay a mortgage insurance

premium.

What’s Escrow?

Taxes and insurance are held in escrow on your behalf. This means the

lender collects these amounts for you and pays them when the bills are due.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

44

Sample Amortization Tables

U.S.MortgageCalculator.org offers an easy way to see how mortgage

payments get applied to the components just described. You can use this

calculator (also available as an Android app) to plug in numbers for your

own mortgage.

Repayment Shock!

Plug your own numbers in the amortization calculator and scroll down to see how much you actually will

pay over the life of your loan.

Did the number shock you? Yes No

When it comes to reducing how much you pay over the life of your loan, make simple reductions in your

outstanding principal. Try it with the calculator to see how just adding $20 a month can reduce the

overall cost of your loan repayment.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

45

Fixed-Rate and Adjustable-Rate Mortgages

To make good financial decisions, you need to understand the types of

mortgage products on the market. Though there is quite a variety,

most are either fixed-rate or adjustable-rate mortgages. Loan terms

can also vary, so it’s important to understand how it impacts what you

pay and when. Think about what you can afford now, but also look

toward the future.

Fixed-Rate Mortgages

These loans commonly are used because they give homeowners a fixed interest rate over the life (also

known as the “term” or time period) of the loan. They often are packaged as 15-year or 30-year terms.

Your monthly payments for principal and interest do not change, although payments for insurance and

taxes can change.

Adjustable-Rate Mortgages (ARMs)

ARMs are popular because they initially offer a lower interest rate. Over time, the interest rate

fluctuates based on an index with which it is associated (like the U.S. Treasury bill rate). Homeowners

need to be particularly aware of how much the rate is allowed to fluctuate, over what period of time,

and what caps may exist. Unfortunately, too many buyers do not contemplate what changes in jobs,

health, the economy or personal financial situations could mean when they initially sign on with an

ARM.

Interest-Only Mortgages

These types of mortgages allow you to make interest-only payments (no principal reduction) for a set

time period at the beginning of the loan. These types of loans can be very risky, however, especially if

the housing market falters. Read more from the Federal Deposit Insurance Corporation (FDIC).

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

46

Check Your Knowledge

Check your understanding of the language common to the mortgage lending industry.

Principal

The actual loan amount

Interest

What you are paying to borrow money for your home purchase

Taxes

An annual property tax amount paid to the county/city where a house is

located and often paid to a lender to be held in escrow

Homeowners Insurance

Held in escrow, the amount paid monthly as part of a mortgage payment

for homeowners insurance

Fixed-Rate Mortgage

Usually a 15- or 30-year term loan with a known interest rate

Adjustable-Rate

Mortgage

A mortgage where the interest rate is tied to an index, like U.S. Treasury

bills

Term

The period over which a loan is repaid

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

47

What to Look for in a Lender

Early in the process of looking for a home, you will want to find a lender

you can trust. Getting preapproved for a loan will make your bid to buy a

home much more attractive.

A trustworthy lender also can help you:

• Determine how much you are qualified to borrow (remember, this is probably above what you

actually will want to borrow).

• Identify the right kind of mortgage for you, your lifestyle and your income projections.

• Determine if you need to improve your credit profile or if you have items in your credit report

that hurt your overall score.

And, just like comparison shopping for a major appliance or car, you will want to compare lenders. Some

have products and rates that can be more advantageous to your needs.

Ask for Credentials

Not all lenders are the same. Make sure your mortgage lender is licensed and

registered at the state or federal level. Ask for credentials related to training

and licensing.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

48

Important Lender Forms

As of October 3, 2015, your lender is required to give you certain forms and disclosures within stated

timelines that will make it easier for you to understand your loan, its terms and what it will cost you.

• Loan Estimate (LE) – You must be given the LE within three business days of your application. It

will help you shop around to compare loan offers. The Consumer Financial Protection Bureau

(CFPB) has a sample LE available with terms defined.

• Closing Disclosure (CD) – Once you’ve selected your lender and made plans for closing, the CD is

a form that gives you the final costs associated with your loan. Use it to compare against the LE

and understand reasons why these two documents might be different. It must be in your hands

no later than three days before your closing date. The Consumer Financial Protection Bureau

(CFPB) has a sample CD available with terms defined.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

49

Special Lending Programs

Owning a home is called the American Dream, but not everyone qualifies for a conventional fixed-rate

loan.

Many first-time homebuyers may not know they are eligible for government assistance programs

backed by the Federal Housing Administration (FHA). Here is a sample of some loans for which you may

qualify.

Loan Type

Pros and Cons

Who Qualifies

Federal Housing

Administration

(FHA) Mortgage

• Pro: Low down payments; as low

as 3.5 percent of the purchase

price

• Pro: Flexible standards for credit

qualification

• Con: A monthly private mortgage

insurance premium is charged to

protect the lender in case of

default on the loan

• Mostly first-time home

buyers

• Could be for refinancing if

little equity has been built

Veterans Affairs

(VA) Loans

• Pro: No down payment

• Pro: No private mortgage

insurance premium

• Pro: Easier than conventional loans

to qualify with lower credit rating

• Con: There are limits on what can

be borrowed

• Most active-duty military and

veterans

• Reservists or National Guard

with more than six years of

service

• Spouses of service members

who died in line of duty or as

a result of service-connected

disability

United States

Department of

Agriculture

(USDA) Housing

Assistance

• Pro: Offers qualification to

individuals who show a willingness

and ability to repay

• Pro: Low interest rates

• Pro: No down payment

• Con: Limitations on income

eligibility and location

• Varies, but most participants

must qualify based on

income levels and be in a

designated rural area

• Also available for elderly,

disabled or rural residents in

multi-unit housing

Read more about the various loans at USA.gov, U.S. Department of Veterans

Affairs, and U.S. Department of Agriculture. You also can find more information

about other federal, state and local programs at HUD.gov.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

50

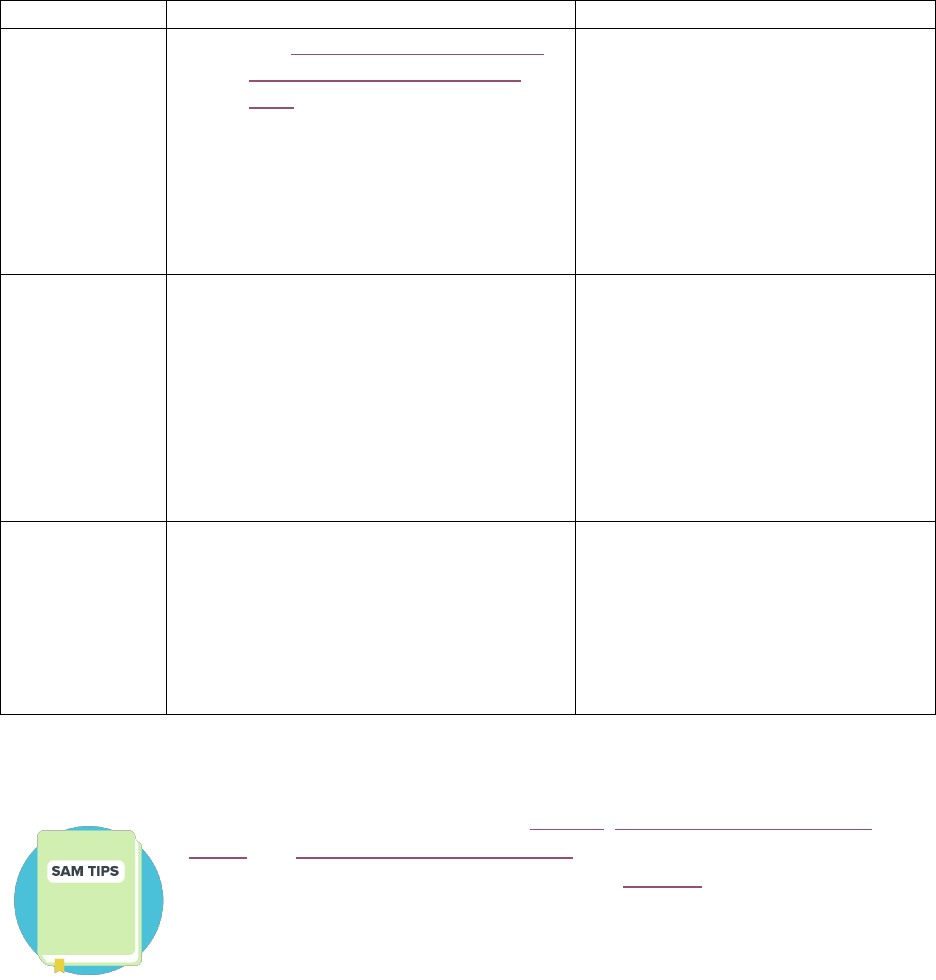

Lenders to Watch Out For

When it comes to making a big decision to buy a home, you need to be

careful about your selection of a lender. Regulations have been

implemented by the Consumer Financial Protection Bureau to help

protect borrowers. The following tips also are helpful to keep in mind.

• Get objective advice. Mortgage lenders are in the business to make money, not to be your

friend. Talk to several lenders before making a decision to go with one. Consult others who can

help you such as friends, family or financial planners to make this decision.

• If it sounds too good to be true, it probably is. If a lender offers up a mortgage that is “just

right for you,” it may turn out to be just right for the lender.

• Read before you sign. Understand the terms of the mortgage, when you have to make

payments, fees and costs associated with taking the loan, etc.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

51

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

52

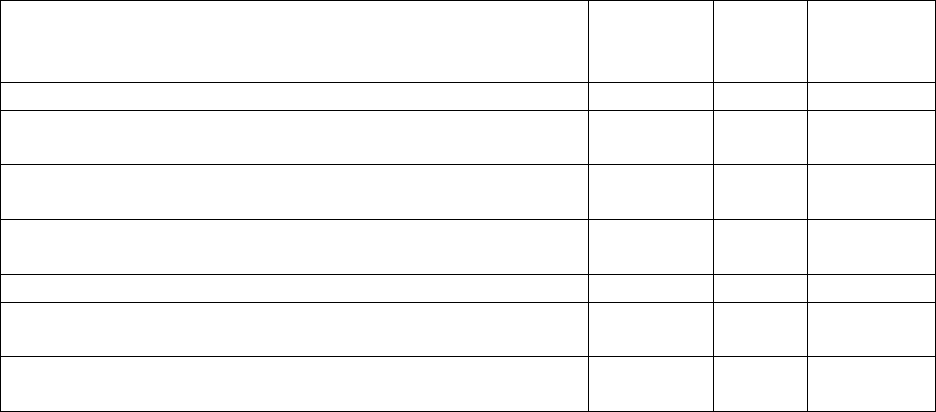

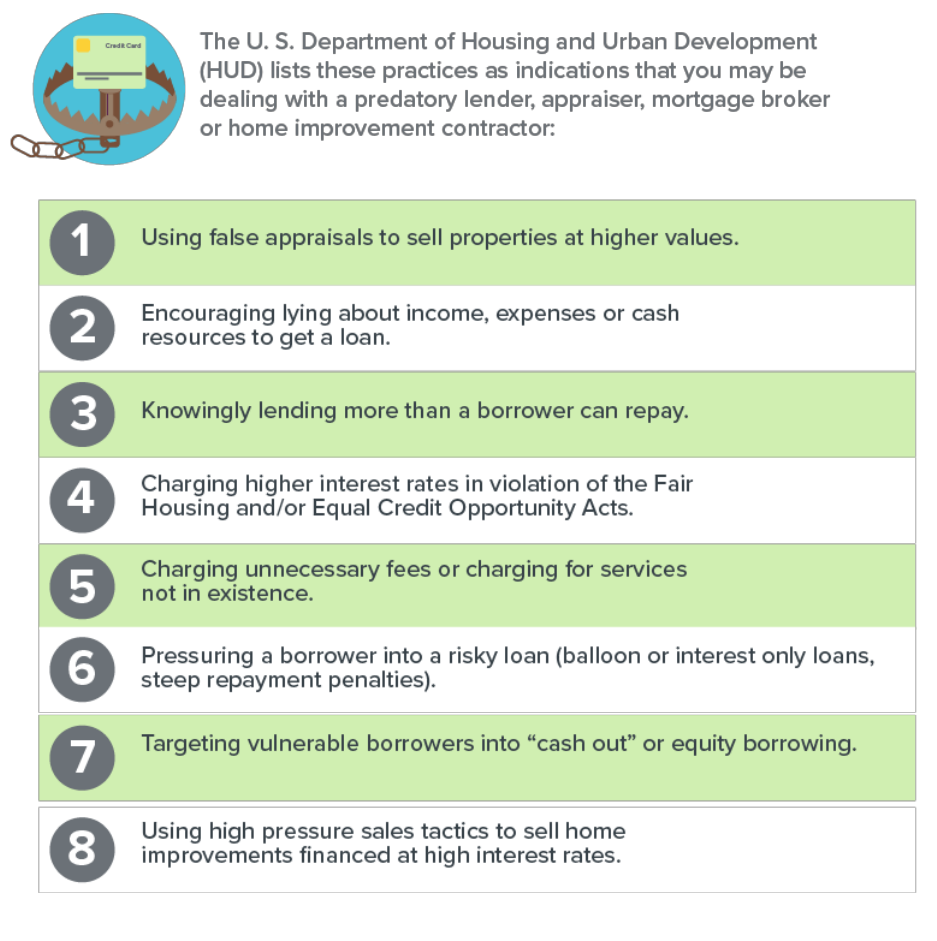

Check Your Knowledge

Can you identify warning signs of an unscrupulous lender? Read the statement of practice and check off

the correct column.

Statement of Practice

Probably

Trustworthy

Run Away!

Overstates your income on a loan application1

Provides you with state credentials and certifications

Has you leave a signature line blank

Gives you a Truth in Lending pamphlet

Asks for verification of your stated income

Changes information you provided on the application

Has you paying interest daily if your loan payment is late

Puts you into a loan where the payment is due in full at the end

of a short period of time

Says there is a prepayment penalty if you pay off the loan

within five years

Presents more paperwork to be signed late in the process

Answers: Probably Trustworthy: #2; #4; #5; Run Away!: #1; #3; #6-#10

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

53

Homeowners Insurance

Homeowners insurance covers your home’s physical

structure, other buildings on your property (e.g., a

detached garage or shed), and personal items for

damages caused by natural disasters and protects you

against accidents and injuries caused to visitors on your

property.

Mortgage lenders require that you carry insurance for the

length of your mortgage.

As a guide, make sure you have enough coverage for the

two main categories in a homeowners’ policy: your home

and your belongings. This should be in the form of

replacement coverage; that is, what it costs to replace

your home and belongings using current pricing and comparable materials.

You also will want to buy coverage in case you need to live elsewhere while repairs are done, and

liability coverage in case others get injured on your property.

Most standard policies offer from $100,000 to $300,000 in liability insurance. You may want to consider

an umbrella liability policy of up to $1 million or even $5 million and extra life insurance to make sure

there will be enough money to pay off the mortgage.

A property and casualty insurance agent can assist you with these decisions.

Dig deeper with SAM’s Insurance Course

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

54

Homeowners Associations and CC&Rs

Many newer communities, no matter the type of home, are governed

by homeowners associations (HOAs). The primary purpose of an HOA

is to maintain property values using covenants, conditions and

restrictions (CC&Rs).

HOA board members are from the community, and they volunteer

their services to help administer the functions of the HOA. The HOA

follows bylaws stating such things as when they meet, the duties of

the members and what voting rights HOA members (homeowners)

have.

CC&Rs are the rules the HOA board enforces to help maintain property values. These rules can restrict

things such as play equipment, fencing, garbage pickup, paint color choices, exterior home decorations,

the use of outdoor clothes lines to hang laundry and roofing materials.

Because there can be hefty fines for the violating the CC&Rs, it’s important to understand and read the

CC&Rs before buying into a neighborhood.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

55

Managing Your Mortgage

When you own your home, you have choices about how to manage

this important asset. Some potential choices you might face as a

mortgage holder include:

Refinancing Your Mortgage

Refinancing your mortgage makes sense when interest rates fall or

if you need a more affordable monthly payment. But there are

scammers out there who will take advantage of your need.

Watch for:

• Solicitations with “limited time” offers.

• Advertisements that falsely claim to be government-sponsored.

• Online sites that request your personal information or upfront fees.

Prepaying Your Mortgage

When you can afford to do it, making an extra payment to the principal on your mortgage can help. Even

a small amount like $25 extra each month can save you thousands of dollars in interest payments over

the life of the loan. But keep in mind that prepaying may not benefit you if you have a low interest rate

but are in a high income bracket since you lose the tax deductions on the interest you pay. In addition,

consider the next best use for the money used to make principal prepayments. Perhaps it can be

invested to earn a higher return than the interest rate on your mortgage,

HUD.gov offers several programs and resources for helping you find ways to

refinance your home. Also make sure you know what your loan states with

respect to prepayment penalties.

Taking Out Home Equity Credit Lines

Sometimes an upgrade or repair to your home may require that you take out a home equity line of

credit (HELOC). This kind of borrowing is secured by the equity in your home, so it is wise to consider

these cautions:

1. If there is a housing market slump, you could end up owing more on your mortgage and HELOC

than your property is worth.

2. Do not take a HELOC to pay off credit card debt. If you find yourself in this situation, it would be

wise to speak with a reputable credit counselor who can help you work out payment terms with

your creditors rather than risk your home.

3. If you fail to make your HELOC payments, you risk losing your home.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

56

Mortgage Foreclosure

If you are unable to make your mortgage payment, you

need to speak to your lender or the company that services

your loan right away. The lender does not want to foreclose

on your home if it can be avoided, but you will need to

show that you are doing everything you can to pay your

bills.

• Check out assistance through local and state sponsored

programs. But be aware that there are many scams out

there.

• Contact your lender to work through alternative

payment arrangements or loan workouts. Have your

budget and documentation ready to show your lender.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

57

Make Your Housing Plan [Own]

Essentially, homeownership is about responsibility. When you own a home, you are responsible for the

upkeep, homeowners insurance, property taxes, utility payments — and most importantly — the

mortgage. Your responsibilities can vary, however, based on the type of home you purchase.

Types of Homes

A home is a major purchase, no matter what its floor plan or style. With the challenges presented in the

current home market, it’s wise to look for homes in different sizes and types, including nontraditional

homes.

Home Type

Descripti

on

Advantages

Disadvantages

Single-family

home

This is

probably

what

most

people

consider

when

they

think of

houses. It

is a free-

standing

residence

, usually

occupied

by one

family.

• Resale values

typically are

higher than

other

housing

types.

• Outside

spaces

belong to

you,

providing

room to

grow a

garden or

enjoy

outdoor

hobbies.

• The freedom

to do as you

please,

unless there

is a

homeowners

association.

• Privacy.

• Recreational

amenities

may be part

of a planned

homeowner

s

association,

but are not

typically part

of an

individual

homeowner’

s property.

• All property

taxes,

insurance

and costs

related to

maintenance

and repair

belong to

the

homeowner.

• Some

communities

are part of a

homeowner

s’

association,

so CC&Rs

may apply.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

58

Townhome

Townho

mes are

usually

multi-

level

units,

attached

by walls

to other

units.

Each has

its own

door to

the

outside.

• Low

maintenance

on common

property if

an

association

takes care of

it.

• Property

values can be

kept higher

because the

association

ensures.

upkeep and

uniformity.

• Prices tend

to be lower

than single-

family

homes.

• Proximity to

neighbors.

• Shared

walls.

• CC&Rs

enforced to

protect,

maintain

and enhance

property

values) can

be

restrictive.

• Violating

association

CC&Rs can

be costly.

Condominium or

Coop

Condos

(and

coops)

are

similar to

apartmen

ts, except

that each

unit is

individual

ly owned

rather

than

rented.

• You own the

space within

the walls,

which can

lower

insurance

needs

compared to

a single-

family home.

• Low

maintenance

on

communal

property

since it is

done by an

association

manager.

• Can be

cheaper to

own than a

single-family

home, but

still provide a

sense of

ownership.

• The CC&Rs

can be

restrictive.

• Violating

association

CC&Rs can

be costly.

• Annual fees

can increase

based on

majority

vote.

• Special fees

or

assessments

can be

levied.

• Privacy.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

59

• Allows for

ownership in

areas where

property

values for

single-family

homes are

particularly

high.

• Security may

be enhanced,

as well as

amenities

like pools,

tennis

courts, gyms,

etc.

Patio home or

duplex

This type

of

housing

only

comes in

pairs.

Dependin

g on the

region,

they are

also

called

patio

homes or

duplexes.

Each unit

is

occupied

by a

single

family.

• From a

buying

perspective,

usually

lower-priced

than a similar

detached

single-family

home.

• If part of an

association,

some

maintenance

(lawn, snow

removal,

painting,

etc.) may be

responsibility

of

association.

• Privacy from

neighbors.

• Smaller

yards.

• If an

association

exists,

CC&Rs can

be

restrictive.

Manufactured

home

These

single-

family

homes

can be

prefabric

ated and

transport

ed to the

site for

• The cost to

construct the

home is

generally

lower than a

single-family

home.

• Energy

efficiencies

can be

• Purchasing

the site and

making

improvemen

ts to it for

the home is

an additional

cost.

• Can’t be

customized

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

60

the home

or built

on-site.

Although

they can

be

moved,

most are

situated

on a

permane

nt site.

achieved in

newer

manufacture

d homes.

• Some newer

communities

offer gated

entry with

associations

that take

care of

maintaining

common

areas.

with respect

to floor

plans or

blueprints.

• Quality of

materials

used in

building may

be less than

other types

of homes.

• Long-term

value

generally

does not

increase as

much as

other types

of homes.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

61

What Kind of Home Do You Want?

To begin thinking about a home choice, narrow your focus down to the type of home you want to

purchase. Take this quiz to help you.

Choices for each are 1-5 scale: 1 = yes, 3 = maybe, 5 = no

1. Rank your choices for each type of home:

Detached single-family home

Townhome

Condo or co-op

Patio home or duplex

Manufactured home

2. Identify your preference for living in a community with a homeowners’ association:

Absolutely! Depends on the CC&Rs No way, my home is my castle

3. Identify your need for privacy:

Very private Somewhat private Who needs it?

4. Rank your preference for performing routine maintenance and repair:

I do it all myself I can do some things I want someone else to be responsible

5. Identify your preference for recreational facilities:

I have no need for these I would like some recreational facilities I want many

recreational facilities

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

62

How to DECIDE

When making a decision to move, no matter whether it’s for a new job, a change in marital status,

retirement or just for the sake of change, you will want to check out several options and choose the

one(s) that fit your lifestyle, values and life circumstances. But first you need to create an inventory of

just what criteria are important to you and the priority they take.

1. Define your goal. What do you want to achieve by purchasing this home?

2. Establish your housing criteria. Which features are wants and which are needs?

3. Choose two to three good options. It’s elimination time. Remove any options without your

must-have features to get your list down to two or three options.

4. Identify the pros and cons. Make a chart so you can quickly compare the features and prices of

each of your top two or three choices.

5. Decide what’s best. Choose the home that best matches your criteria.

6. Evaluate your decision. Did you stay within budget? Do you feel good about your home? Set a

plan for how long you will live in your new place and start saving for your next move.

SAM Housing Plan Course | LWVT REVIEW | 5/31/22

63

Create Your Checklist

It doesn’t matter why you’re looking for a new place to live –

your first place, retirement, expanding family, downsizing, a new

job, divorce or just a fresh start – you’ll want to look at a lot of

different factors that make it your ideal place. You also will need

to decide which ones take top priority in making your decision.

Set Some General Guidelines

To aid your decision making, create a checklist when comparing your housing choices. Before you can

create your checklist, however, it helps to have some general guidelines to use. Use these sentence

starters to help you think about things you want to maintain from your current living situation, improve

on or change:

• In my current housing situation, I like ________________, and I want my new place to have that

as well.

Example: In my current housing situation, I like that there are two bedrooms, and I want my new